Unlocking Long-Term Capital to Drive Growth

As demand for medium- and long-term capital surges—particularly for infrastructure and manufacturing projects—Vietnam’s financial market remains constrained by a lack of efficient and sustainable funding channels. Legal bottlenecks and an underdeveloped market structure are obstructing long-term capital flows, directly affecting the country’s recovery and economic growth potential.

Long-Term Capital: Critical, Yet Constrained

According to VIS Rating, one of the biggest bottlenecks in the corporate bond market is the limited participation of major financial institutions such as banks and insurance companies. Currently, these institutions are not permitted to invest in bonds issued for refinancing purposes—an issue that contributes to poor liquidity and elevated issuance costs.

In fact, during 2024–2025, refinancing bond interest rates have ranged between 11–13%, significantly higher than bank lending rates. As a result, enterprises face difficulties in accessing reasonably priced capital, especially as the volume of maturing bonds continues to rise.

Inefficient Issuance Mechanisms

Beyond legal constraints, the current bond issuance process poses considerable challenges for issuers. Companies are required to split offerings into multiple tranches, each involving separate approval procedures—driving up both cost and time.

Moreover, the regulation limiting offering periods to within six months is considered ill-suited for long-duration projects. Beginning July 2024, credit institutions will also face restrictions on managing collateral for bonds, further reducing their ability to support and underwrite new issuances.

Mismatch Between Supply and Demand

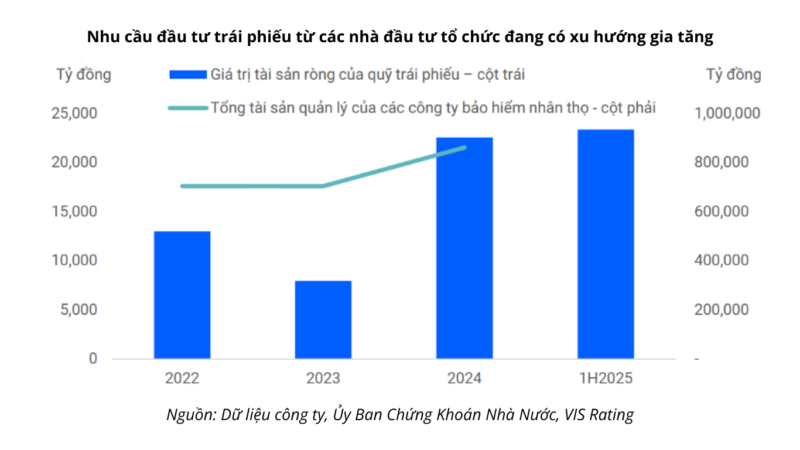

While many businesses are in urgent need of capital, institutional investors—such as investment funds, insurers, and pension funds—struggle to find suitable bond products. Demand for fixed-income, transparent, and low-risk instruments is strong, but the market currently lacks a sufficient supply of high-quality offerings.

In Vietnam, the social insurance fund and private pension funds are not yet allowed to invest in corporate bonds. Meanwhile, life insurance companies allocate less than 10% of their portfolios to bonds—a figure far below international norms.

Clear Legal Framework and Credit Guarantees Needed

Experts believe that unlocking long-term capital will require foundational policy reforms. Allowing banks, insurance companies, and pension funds to participate in the corporate bond market could provide a major boost—but must be accompanied by a clear legal framework, robust post-issuance oversight, and transparent credit rating mechanisms.

Introducing credit guarantee schemes—especially for infrastructure bonds during the construction phase—would also be a key step in reducing risk and restoring investor confidence.

Toward Sustainable Economic Development

As commercial banks face growing short-term liquidity pressure, developing a long-term capital market is essential to sustaining economic growth. If legal and structural barriers are addressed appropriately between 2025 and 2027, the corporate bond market could evolve into a strategic capital mobilization channel for the Vietnamese economy.

Source of reference: https://vneconomy.vn/